This post is a response to a post made by Paul Krugman for The New York Times.

Krugman starts with why bitcoin is not a good store of value.

To be successful, money must be both a medium of exchange and a reasonably stable store of value. And it remains completely unclear why bitcoin should be a stable store of value. Brad DeLong puts it clearly:

“Underpinning the value of gold is that if all else fails you can use it to make pretty things. Underpinning the value of the dollar is a combination of (a) the fact that you can use them to pay your taxes to the U.S. government, and (b) that the Federal Reserve is a potential dollar sink and has promised to buy them back and extinguish them if their real value starts to sink at (much) more than 2%/year (yes, I know).”

Placing a ceiling on the value of gold is mining technology, and the prospect that if its price gets out of whack for long on the upside a great deal more of it will be created. Placing a ceiling on the value of the dollar is the Federal Reserve’s role as actual dollar source, and its commitment not to allow deflation to happen.

Placing a ceiling on the value of bitcoins is computer technology and the form of the hash function… until the limit of 21 million bitcoins is reached. Placing a floor on the value of bitcoins is… what, exactly?

What Krugman refers to is the fact that usage increases the value of a currency. He is right about that. Forcing people to use the dollar to pay taxes is what gives the dollar more stability. Usage increases value. This is because the free market works in both ways. If you buy a good or a service, its cost is the result of supply and demand. It’s pretty obvious to see this. But what gives currency value? It’s the same principle of supply and demand that gives currency value. If you need to use a currency for a certain purpose, you need to store it for a certain amount of time before you can use it. The fact that you need to store a unit of currency, is part of the demand. Look at it this way: Assume you have a million units of a currency. Distribute them over the whole population of a country. The value of one unit is directly correlated to the amount of units that are in circulation. How much do you want to pay someone for a service? It depends on how much you earn yourself, but also on how much money you have in possession.

If your government forces you to use their preferred currency, it raises the value of that currency. But, taxes are just a small part of the demand for currency. In the same way, the usefullness of gold (in for example electronics and jewlery) is only a small portion of the current value of gold. The major value of a currency is contained in the usage beyond taxes. For gold, these are private owners and central banks who believe in the long tradition of gold as the sole provider of money (which is actually a form of speculation).

Of course, Krugman is not just talking about value here. Krugman is talking about stability. How about that? If you demand that taxes have to be payed in a certain currency, it sure raises the stability of that currency, how little the effect is. The fact that there is a certain bottom of a currency doesn’t mean that it has high stability. As a matter of fact, there is always a bottom as long as there is demand. But if the dollar crashes to its current bottom, what insurance do we have that people will continue to pay taxes? There is no way anyone can determine a bottom or “underpin” a currency. History tells us that such a bottom does not exist and in the long term, the free market always decides the right price of a unit currency.

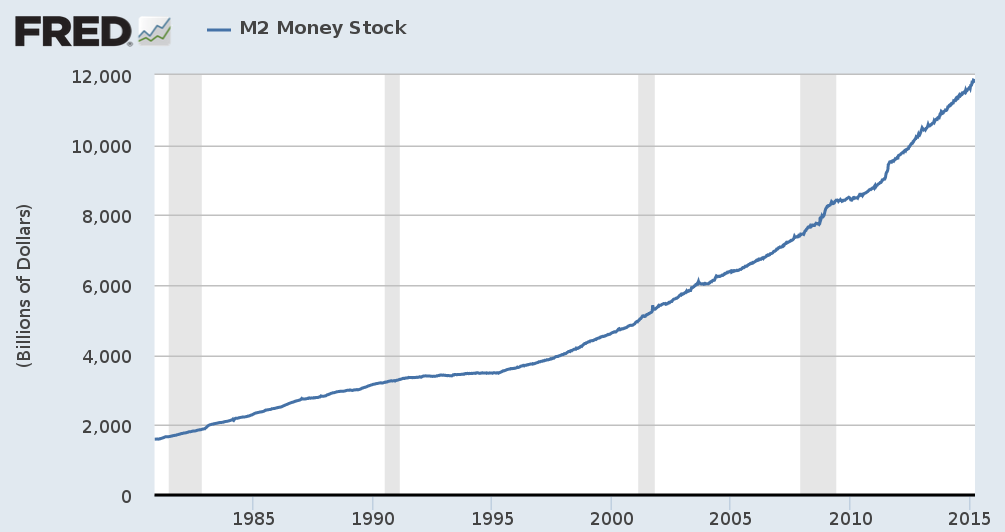

Like in the Weimar Republic and Zimbabwe, the supply of the dollar has been increased dramatically over time.

It’s not a wonder that the purchasing power of the dollar has dwindeled since the introduction of the Federal Reserve.

It’s not a wonder that the purchasing power of the dollar has dwindeled since the introduction of the Federal Reserve.

I believe the international character of bitcoin is a much stronger argument for stability than the fact that you have to pay taxes with it since international markets are much more complex. The value of the dollar is pegged to the U.S. economy. A few bad economical decisions can cause a serious blow to its value. Bitcoin is immune to this.

Krugman also mentions that the Federal Reserve can act as a potential dollar sink. It’s not really clear what he means by this. I guess he refers to the fact that the Federal Reserve can exchange dollars for government bonds. It’s still to see if that will solve the potential problem of hyperinflation.

The only reason why bitcoin might not be a good store of value is the fact that is not widely used. Not because it is not backed by a central bank.

I have had and am continuing to have a dialogue with smart technologists who are very high on BitCoin — but when I try to get them to explain to me why BitCoin is a reliable store of value, they always seem to come back with explanations about how it’s a terrific medium of exchange. Even if I buy this (which I don’t, entirely), it doesn’t solve my problem. And I haven’t been able to get my correspondents to recognize that these are different questions.

Krugman fails to see that the future ease of use of bitcoin and the massive applications that could possibly be built around the blockchain technology actually makes it so valuable. Let me explain why. Just forget about bitcoin as a store of value for a moment. Think about the possibilies of the blockchain technology. Krugman refers to the fact that bitcoin is terrific medium of exchange (which he doesn’t entirely believe, but it is). You can build smart contracts with bitcoin, automate payments or pay for anything with just scanning a qr code without the interaction of a financial institution. This is quite revolutionary. Bitcoin is a standardized, independent payment system that allows immediate transactions between individuals without the intervention of a financial institution. When the technology around bitcoin matures, it will be easier to pay with bitcoin than it is to pay with conventional methods, even for the biggest technophobes. You can compare it with the beginning of the internet. You had to enter an ip address in order to connect with a website. Now you can just enter the name of the website you want to visit and lately you can call up a website with a simple voice command. The same thing will happen with the bitcoin technology. Your bitcoin wallet will be connected with an exchange of your choise, so if you spent bitcoins you can immediately buy them back. It will be connected to address books, social networks, online marketplaces, video messengers, etc. Spending/giving/donating money will become a no brainer.

Since bitcoin can be sent directly from person to person, anyone can use it. Therefore, bitcoin is massively interesting for the unbanked, which are estimated at a 2.5 billion [2012].

To be a medium of exchange, bitcoin doesn’t need to be stable. Exchanging dollars or euros for bitcoins just requires temporary stability. Even long term this doesn’t really matter. People who are concerned about stability can always rebuy their spent bitcoins. It doesn’t need stability to survive. The value of bitcoin is defined by its use, and since the supply of bitcoin is limited the value will be huge. Because bitcoin is not backed by a central bank, it will always be somewhat volatile. But that doesn’t matter. Gold is also quite volatile and it is still seen as a good store of value.

To make the analogy with the internet, what if the internet would be centralized in one place. It would not be possible to expand the internet. The internet would just be a certain network somewhere in the world that has a fixed amount of routers, cables and data storage. Anyone in the world can connect to this network and it is the only network that will ever exist. In order to participate, you must buy a piece of this network from someone else. Everytime you use it, you have to sell a piece of your share to another participant on the network. There is no bottom on the price of a piece of this internet, nor is there a ceiling. Still, it would be an excellent store of value.

To make the analogy with the internet, what if the internet would be centralized in one place. It would not be possible to expand the internet. The internet would just be a certain network somewhere in the world that has a fixed amount of routers, cables and data storage. Anyone in the world can connect to this network and it is the only network that will ever exist. In order to participate, you must buy a piece of this network from someone else. Everytime you use it, you have to sell a piece of your share to another participant on the network. There is no bottom on the price of a piece of this internet, nor is there a ceiling. Still, it would be an excellent store of value.

You may not forget that no one can take down bitcoin. Even not the developers. Bitcoin will be around in 100 years, whatever the value.

Then Krugman continues about the economics behind bitcoin.

BitCoin looks like it was designed as a weapon intended to damage central banking and money issuing banks, with a Libertarian political agenda in mind—to damage states ability to collect tax and monitor their citizens financial transactions.

First of all, it is perfectly possible to collect taxes on wages that are earned in bitcoin, the same counts for products that are payed for in bitcoin. There are two kind of taxes that are hard to collect. The first one is taxes on the wages of jobs that can be payed for in cash. But these taxes can easily be evaded anyway. And as a matter of fact, bitcoin transactions are less anonymous than cash transactions. The other tax that is hard to collect is the tax on capital, since bitcoins can only be accessed by a (combination of) private key(s). But this is an evil tax anyway. Bitcoin is a completely transparent system that can be very helpful in preventing fraud. It is clear that a statist like Krugman doesn’t like the idea of a fair and transparent monetary system.

2 thoughts on “Krugman Is Evil”

Comments are closed.